The Competitive Positioning Framework That Actually Wins Deals for B2B Agencies

Nov 29, 2025

Let's be blunt. A competitive positioning framework is a plan that proves choosing your B2B agency is the smartest, safest decision a client can make. It's not a list of services. It's an evidence-backed story that forces a buyer to see you as the only logical choice.

This framework becomes the single source of truth for your sales pitches, your website copy, your ads. It makes sure every word you use connects with what buyers actually care about.

The Brutal Reality Check

Your polished case studies and claims of "vertical expertise" are now just hygiene factors. They are the bare minimum needed to get a first look. If you think that’s enough to win deals in 2025, you’re quietly losing opportunities you don’t even know exist.

Here's the truth: your most important deals are decided long before an RFP hits your inbox. The real decisions happen in private Slack channels, vendor-matrix Notion boards, and whisper networks. By the time you get a formal request, the buying committee has probably already picked a favorite.

If your positioning still starts with “who we are,” you’ve already lost. Buyers don't care about your founding story or your exhaustive list of services. They are judged on the results they deliver and are terrified of making a bad call.

All they want to know is which choice will solve their problem and advance their career without getting them fired. Your "me-focused" approach forces them to connect the dots between your services and their problems. Most won't bother.

This guide lays out a competitive positioning framework for how deals are won today. It's a reality check on what it takes to convince a budget holder to say yes.

The goal isn’t to be the best agency. It’s to be the only logical choice for a specific, high-stakes problem.

Understanding the real drivers behind a purchase is non-negotiable. This means knowing the entire market your customer operates in. For a deeper look, you can explore our guide on how to analyze market trends to inform your strategy.

This framework shows you how to stop competing on features and start winning on clarity, proof, and risk reduction. Fix the positioning first, and the work starts to sell itself.

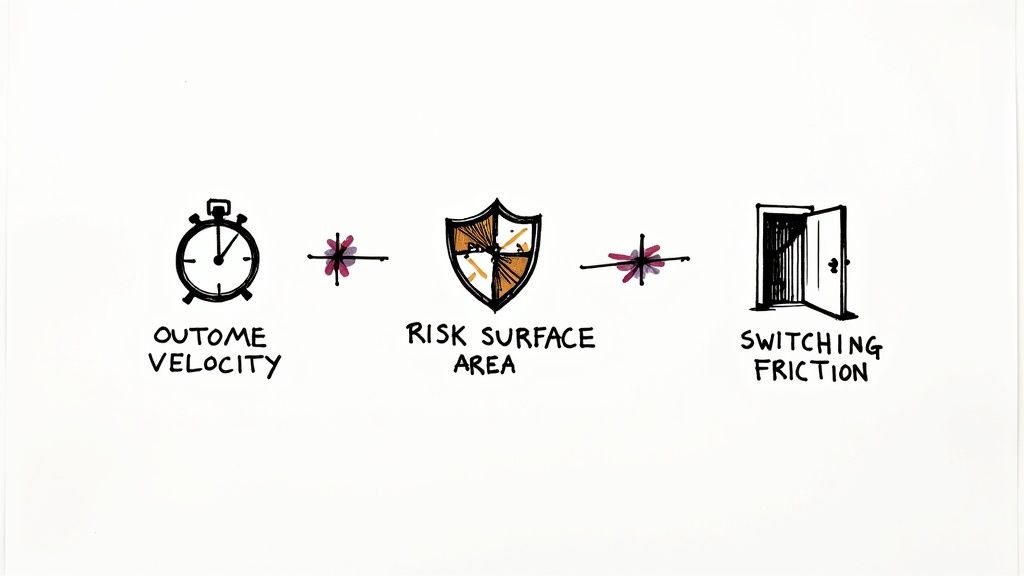

The New Positioning Trinity (Forget the Old Value-Prop Pyramid)

Those old-school value proposition pyramids are relics. They were built for an era when sellers held all the cards. That world is gone.

Today's buyers care about three things. If your competitive positioning framework doesn't speak directly to these levers, you're just noise. Everything else is a distraction.

This is the New Positioning Trinity. It’s a shift from talking about what you do to articulating what you change for the buyer’s business and their career.

Outcome Velocity

This is your primary lever: how fast you move their P&L needle. Your buyer has a boss who wants to see progress now. The question in their mind is, "How many weeks until I can report a tangible win from this investment?"

Instead of promising a grand overhaul in twelve months, your positioning needs to scream "first value." A dev shop can promise to ship one high-impact feature in four weeks that cuts customer churn by 2%. A performance marketing agency might highlight a 15% drop in cost-per-acquisition within the first 60 days.

Outcome Velocity is your weapon against inertia. It makes the cost of doing nothing feel immediate and painful.

Risk Surface Area

Every B2B purchase is a career bet. When a director signs that contract, they're staking their reputation on your team. Your positioning must systematically shrink their perceived Risk Surface Area.

This isn't just about project failure. It's a bundle of fears:

Career Risk: "Will this flop and make me look incompetent?"

Political Risk: "Will this alienate the sales team and create internal drama?"

Compliance Risk: "Does this agency understand our industry’s data privacy rules?"

You don't combat this with promises of "partnership." You do it with concrete de-risking mechanisms: performance-based pricing, clear opt-out clauses, or a shared Slack channel with your senior engineers. You're not just selling a service; you're selling career insurance.

The less risk a buyer feels, the faster they sign. Your job is to make choosing you feel as safe as keeping their mediocre vendor, but with a much higher upside.

This isn't just theory. Research shows that companies with a clear, focused strategy, like one that lowers buyer risk, pull in 25-35% higher profit margins and see 35-45% higher customer retention. You can dig into more insights about market positioning and its direct link to profitability.

Switching Friction

The final piece of the trinity is Switching Friction. This is the real-world pain of firing an incumbent and getting a new partner up to speed. Buyers dread it. They imagine endless meetings, data migration nightmares, and a frustrating learning curve.

Your positioning must tackle this head-on. Don't pretend it doesn't exist. Show them you've already solved it with a simple onboarding plan.

A software agency could offer:

A dedicated onboarding engineer to manage the entire transition.

A guaranteed one-day knowledge transfer with the outgoing vendor.

Pre-built integrations for their existing project management tools.

By mapping out and solving for this friction upfront, you dismantle one of the biggest barriers to getting a "yes." You make the decision to switch feel organized, not chaotic.

Outdated Pillar | New Trinity Equivalent | What Buyers Are Thinking |

|---|---|---|

Product Features | Outcome Velocity | "Your features are irrelevant. Show me how fast I get a tangible business result I can report to my boss." |

Company Credentials | Risk Surface Area | "I don't care that you won an award. Prove to me this project won't get me fired." |

Implementation Process | Switching Friction | "Don't just tell me it's easy. Show me a concrete plan that removes the headache of moving from my current vendor." |

Focusing on the Trinity doesn't just make your messaging more compelling. It aligns your entire go-to-market strategy around what your ideal customers actually care about.

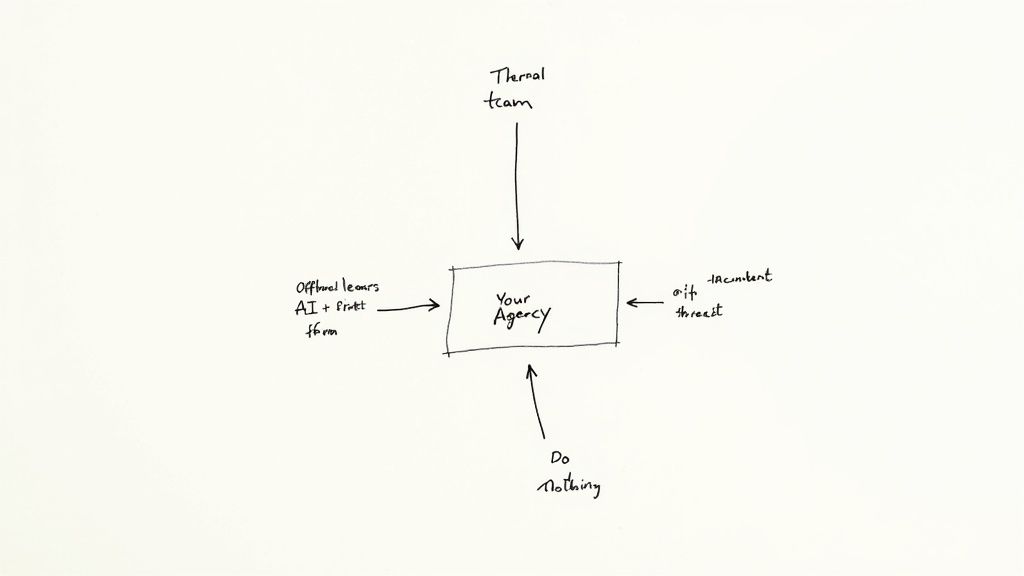

Map Your Shadow Competitors First

That competitive slide in your pitch deck is probably a lie. You've listed the three other agencies that show up in the same RFPs, feeling confident you know the battlefield.

You’re fighting a phantom war.

While you build battle cards against Agency X, your buyer makes a completely different set of comparisons in a private Notion doc. Your biggest failure in any competitive positioning framework is positioning against the rivals you see, not the alternatives the buyer actually considers.

Your real competition is a messy group of "shadow competitors." Ignoring them is like preparing for a boxing match when your opponent is planning a chess game.

Uncovering the True Consideration Set

To win, you have to map the battlefield from the buyer's perspective. Your real competitors fall into a few key categories.

Internal Teams: The default choice. The buyer thinks, "Maybe we can handle this ourselves." Your positioning must expose the hidden costs: pulling their best engineers off core product work and the risk of a delayed, subpar result.

AI + Freelancers: The modern DIY option. "Why pay an agency when I can use AI tools and a freelancer?" You must highlight the hidden management overhead, lack of strategic ownership, and integration chaos that follows. You’re selling a guaranteed outcome, not code.

The Incumbent They Hate: The fear of change is powerful. The devil they know feels safer. Your job is to make the pain of staying greater than the pain of switching, focusing on the slow erosion of results.

"Do Nothing + Reallocate Budget": The most dangerous competitor. It’s a decision to wait or spend the money elsewhere. You defeat this enemy by quantifying the cost of inaction. Show them the revenue they’re leaving on the table every quarter they delay.

Systematically gathering this information is a core part of building a robust competitive intelligence function. For more depth, check out our guide on what is competitive intelligence.

Position Against the Real Shortlist

Once you’ve identified these alternatives, your messaging must adapt. A generic value prop is useless. You need sharp counterarguments for each.

Think of it like a matrix. On one axis, you have your New Positioning Trinity. On the other, you list each shadow competitor.

When positioning against the internal team:

Outcome Velocity: "Your team can build this in six months. We’ll deliver the first P&L-moving feature in six weeks."

Risk Surface Area: "What happens if your lead engineer leaves mid-project? Our team structure guarantees continuity."

Switching Friction: This isn’t about a vendor, but the friction of starting an internal project. You counter this with a simple onboarding process that requires minimal time from their key people.

This approach turns a generic framework into a deal-winning machine. It shows the buyer you understand the complex, risky decision they are about to make.

Businesses that embed this detail into their strategy see clear results. Data shows companies using comprehensive frameworks achieve 35-40% better strategic clarity. Maintaining an updated competitor matrix is directly linked to an improved ability to predict market moves.

Stop analyzing other agencies’ websites. Your real competition is the internal debate in your buyer’s head. Win that debate, and you win the deal.

The Proof Stack That Actually Moves Budget Committees

Your beautifully designed case studies are now the least convincing asset you have. Buyers see them for what they are: glossy brochures. In terms of credibility, they've hit rock bottom.

To win deals today, your competitive positioning framework needs a foundation of evidence that feels raw, authentic, and hard to fake. I call this the Proof Stack. It's a hierarchy of credibility. If your sales narrative still relies on the bottom of this stack, you’ll keep wondering why proposals get ghosted.

The New Hierarchy of Evidence (in order)

The higher you climb the stack, the more trust you build, and the faster you close.

Internal Slack/Teams Screenshots of Your Impact: This is the undisputed champion. Nothing beats a screenshot from your client’s internal Slack where their project lead praises your team's work. It's unfiltered, contextual, and shows your impact in their own language.

Redacted Before/After P&L Lines: Money talks. Showing a redacted financial statement or dashboard that clearly illustrates the "before" and "after" of your work is powerful. It cuts through the fluff and speaks directly to the scoreboard that matters to an executive.

Private Peer Referral Threads: This is proof that happens when you're not in the room. An email or LinkedIn message where a happy client introduces you to a peer carries far more weight than any public testimonial.

Case Studies (Yes, Now Dead Last): They still have a place, but it's dead last. They provide a structured narrative and are useful for box-ticking in formal procurement processes. They are supporting actors, not the main event.

How to Systematically Source This Proof

You don't stumble upon these assets. You build a process to hunt for them.

It starts by changing the questions you ask in client check-ins. Stop asking, "How are things going?" That gets you a generic, "Fine, thanks."

Instead, get specific:

"What was the single most helpful thing our team did for you this week?"

"Has this new feature shown up in any of your internal dashboards yet?"

When you get a positive response, your next move is critical. Ask for the evidence. "That's fantastic. Would you be open to sharing a redacted screenshot of that Slack message or dashboard? It would mean the world to our team." Most clients will say yes.

This simple tweak transforms account management into a proactive proof-gathering engine. You’ll build an arsenal of assets your competitors, still churning out PDFs, cannot match. Build your entire narrative around the top three tiers of this stack, or keep wondering why proposals get ghosted.

The Agency Positioning Self-Audit (Score Yourself 1-100)

With your framework in place, it's time to deploy advanced plays that create a measurable gap between you and the competition. These are strategic moves designed to address a buyer's deepest anxieties and dramatically shorten the path to a signed deal.

The goal is to stop playing the same game as everyone else. Instead of listing your strengths, you're going to reframe the buyer's entire decision-making process in your favor. Here is a quick diagnostic. Anything under 80 and you’re quietly bleeding deals you’ll never see.

Negative Positioning (The Polite Knife)

Stop bragging. Start calmly exposing the hidden costs, delays, and career risks of every alternative, including their beloved incumbent and the “we’ll just build it ourselves” fantasy.

You can do this by walking a prospect through the most common points of failure. If they bring up building a solution internally, you might say, "That can work. The two places we see that stumble are when the project gets deprioritized, or when a key developer leaves. How have you insulated this initiative from those risks?"

This single flip, from bragging to exposing genuine risks, builds incredible trust. You're no longer another vendor; you're a strategic advisor. Done well, this doubles your win rate in head-to-heads.

The Outcome Velocity Scorecard

Create one public, brutally transparent page showing median “weeks to first measurable result” and “weeks to full ROI” across your last 20–30 clients, segmented by size/scope.

This tactic works because it answers the buyer's most urgent question before they even have to ask it. It pre-empts the "how long will this take?" conversation with hard data. Agencies that publish this close deals 30–50 % faster because buyers self-qualify.

Positioning for the Post-RFP Dark Funnel

Most budget is committed before any RFP drops. Build an ungated microsite or comparison engine where prospects anonymously score you vs. their real alternatives on the Trinity (Outcome Velocity, Risk Surface Area, Switching Friction). Watch the IP addresses of visitors and trigger sales outreach the moment a high-intent account lands on the page. This allows you to engage qualified buyers before they ever formally reach out.

The "Anti-Agency" Position (The Nuclear Option for Mid-Sized Firms)

Deliberately brand yourself as the opposite of traditional agencies: fixed-outcome pricing, no timesheets, shared Slack channel, money-back triggers, embedded pods.

This stance directly attacks everything buyers hate about the old model:

No more hourly billing: You switch to fixed-outcome pricing.

No more black-box communication: You operate out of a shared Slack channel.

No more vague promises: You build in money-back triggers tied to clear KPIs.

This stance alone collapses sales cycles from months to weeks. It's a potent strategy for dev shops tired of competing on scope and hours. For more on structuring these offers, check out our B2B agency playbooks.

The 90-Day Risk-Reversal Roadmap

Ditch the 40-page proposals. Nobody reads them. Replace it with a signature-ready one-pager: the 90-Day Risk-Reversal Roadmap. Hand every serious prospect a dated document that spells out onboarding SLAs, weekly impact reports, and a no-questions-asked offboarding clause if you miss KPIs.

Agencies using this close 3x more retainers than those sending bloated proposals because it makes saying "yes" feel like a low-risk experiment.

This infographic shows the modern hierarchy of evidence that budget committees actually find convincing.

As the pyramid shows, raw, internal proof like Slack screenshots and tangible P&L impact carries far more weight today than a polished case study. These advanced plays shift you from a passive vendor to an active partner who guides the buyer to the smartest, safest decision, which just happens to be you.

Final Line

Great creative, media buying, or code is now irrelevant if your positioning doesn’t make the buyer feel stupid for choosing anyone else. Fix the positioning first—then the work sells itself.

At 100Signals, we help dev shops and B2B agencies get this right by providing the market intelligence needed to validate your positioning against real buyer behavior and intent. We distill industry trends and competitor moves into a clear report, so you can build a framework that wins deals right now. See how it works at 100signals.com.

© 2026 100Signals. All rights reserved.