Economic Update: June 2024

Jun 24, 2024

This page provides insights into key market trends and forward-looking economic indicators, helping you forecast future demand.

Updated: June 2024

Economic Outlook: Cautiously Optimistic

Recession risks remain elevated;

Cooling inflation suggests the Fed rate may drop to 5.0% by year-end;

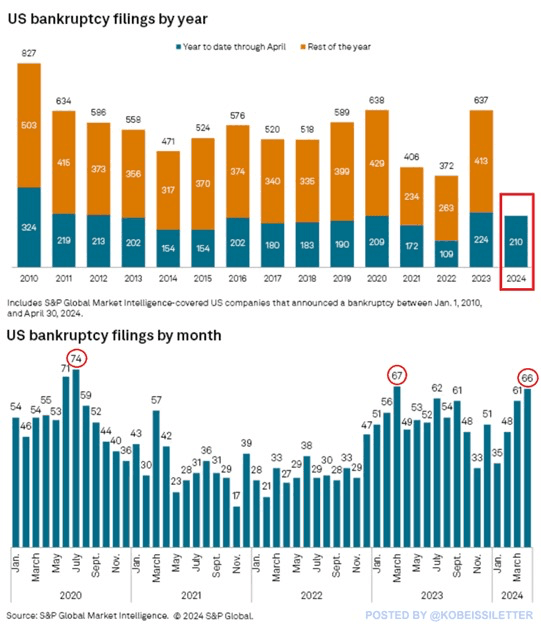

High corporate bankruptcy rate persists;

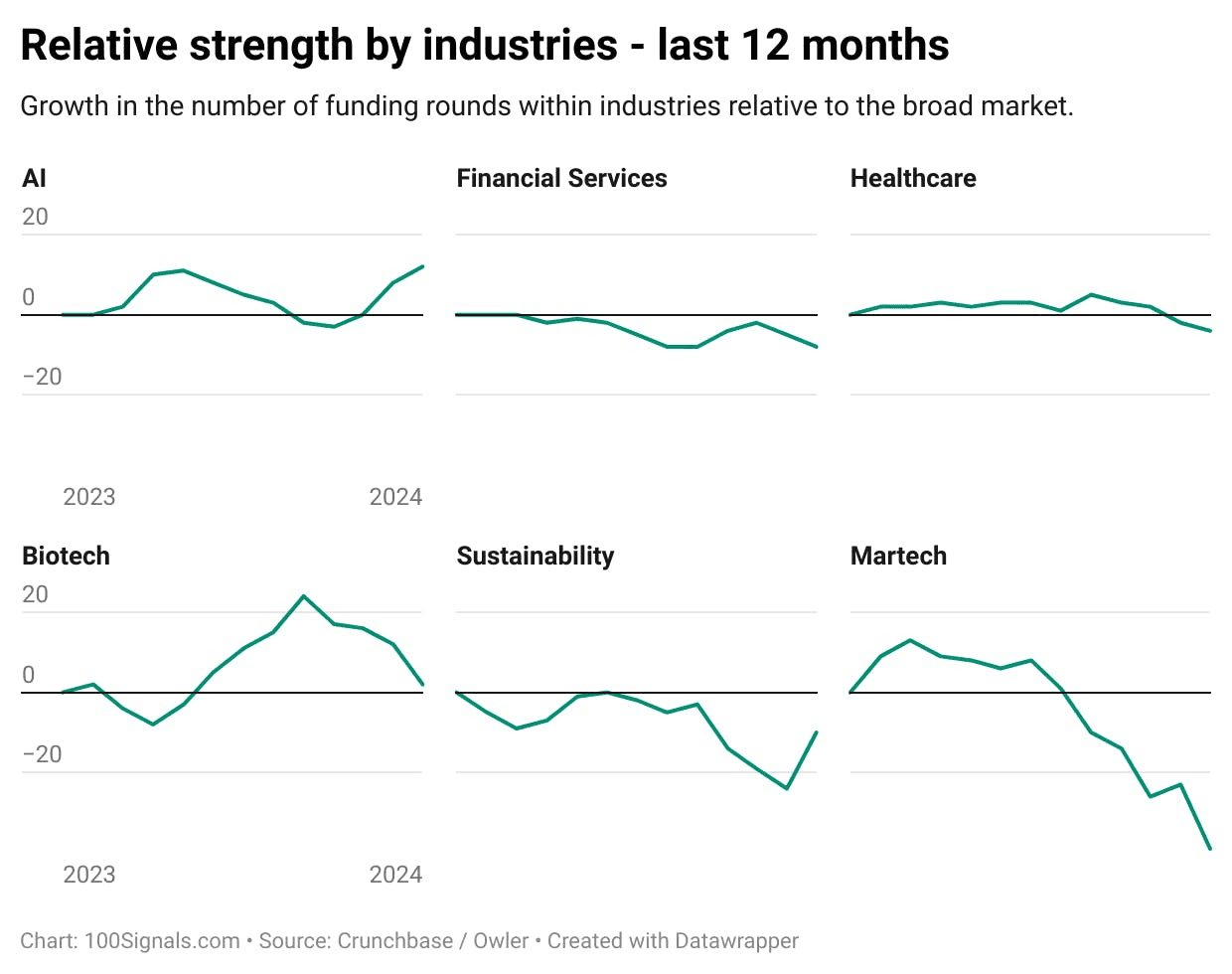

Tech funding rounds remain limited, though median amounts are increasing;

AI continues to attract strong investor interest;

Still low number of layoffs.

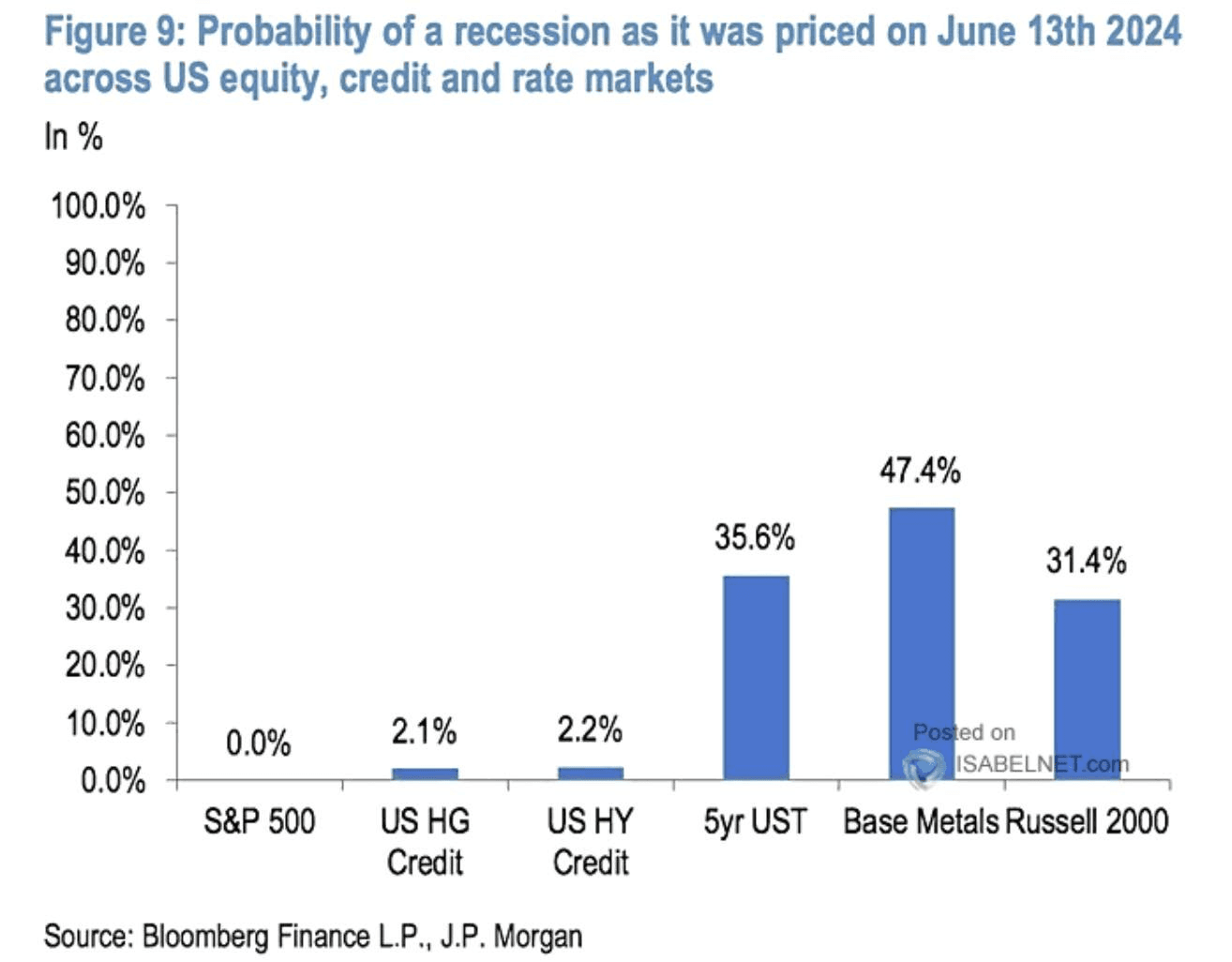

U.S. recession probabilities.

Recession probabilities remain elevated, indicating a potential economic downturn.

Based on the yield curve:

The markets are more optimistic:

The LEI did not signal a recession for the second consecutive month due to improvement in the six-month growth rate:

U.S. Fed funds rate projections.

Expect lower interest rates ahead, dropping to below 5.0% by year-end.

This could mean easier financing conditions and better investment opportunities.

U.S. job market data.

U.S. corporate bankruptcies.

In the first four months of 2024, the U.S. saw 210 corporate bankruptcies, with April’s 66 filings marking the third-highest monthly number since 2020, significantly impacting the Consumer Discretionary and Healthcare sectors.

Funding in tech sector.

Funding rounds ares still down across all stages, but the median round amount is up.

Investors are selective, but committed capital per round has increased, signaling confidence in chosen startups.

Layoffs.

In May, the tech industry experienced 77 layoff events, affecting over 29,000 employees, with 66% of the layoffs attributed to just three companies: Li Auto, Paytm, and Toshiba.

Sign up for our monthly reports for software development agencies.

© 2025 100Signals. All rights reserved.